Results highlights

- +44%Technology Solutions revenue growth

- £52m Group adjusted EBITDA

- +£356m Improvement in underlying cashflow

Over the last year, we have made strong financial, operational and strategic progress. Today we report strong revenue growth, positive adjusted EBITDA and improving cash flow across all of our businesses.

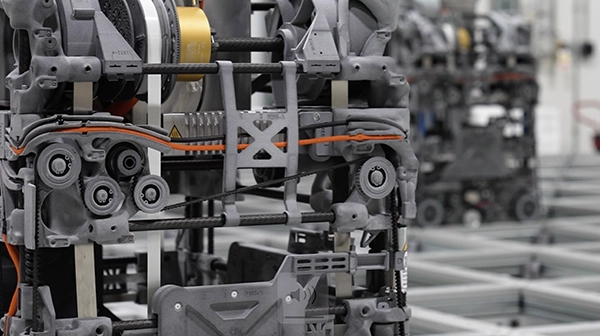

In the past 12 months, we opened three new state-of-the-art robotic CFCs; in Chiba city (near Tokyo) in Japan, Calgary in Canada, and Luton in the UK and increased the amount of installed capacity for our partners by a quarter. Our In-Store Fulfilment solution is operational in over 1,000 stores worldwide. We now have installed capacity at our retail partners for gross annual grocery sales of over £8bn at maturity. And, today, we have announced the signing of our 13th partner to the ‘OSP club’.

During 2023 Ocado Intelligent Automation, which brings our world-leading Automated Storage and Retrieval Systems (“ASRS”) technology, and the automation of warehouses to sectors outside of grocery, signed its first deal with pharmaceutical giant McKesson in Canada.

In the UK, Ocado Retail has returned to profitability, reflecting the combined results of the ‘Perfect Execution’ programme, which has driven improved customer proposition and service levels, and active customer growth and improving operating efficiencies in fulfilment and delivery.

The primary focus of the business is now helping to put our partners well on the path to generating attractive returns from their investment in the Ocado Smart Platform, a key deliverable to drive orders for more capacity in their existing sites and additional future sites. We are encouraged by the progress we are making through our Partner Success programme helping our partners to get the best out of the technology that we have successfully installed for them.

Ocado Group’s own performance in FY23 is down to our teams and their disciplined execution, driving financial, strategic and operational progress across the Group. I’m proud to witness the day-to-day energy, passion and commitment to innovation shown by our colleagues.

Results table

* These measures are alternative performance measures. Please refer to section 6 of the Consolidated Financial Statements

1. Adjusted EBITDA* is defined as earnings before net finance cost, taxation, depreciation, amortisation, impairment and adjusting items*.

2. Direct operating costs as a % of installed sales capacity reflect the P12 exit rate position for all OSP CFCs live at the period end. Direct operatingcosts include engineering, cloud and other technology direct costs.

3. Underlying cash flow* is the movement in cash and cash equivalents excluding the impact of adjusting items*, costs of financing, purchaseof/investment in unlisted equity investments and FX movements. The FY23 underlying cash flow* number is based on 53 weeks.

4. Average live modules measures the weighted average number of modules of capacity installed and ready for use by OSP clients during the year,which drives Technology Solutions recurring revenue.

5. Revenue is a. Retail - online sales (net of returns) including delivery charges to the customer b. Technology Solutions - the fees charged to Solutionspartners and OIA clients and c. Logistics - the recharge of costs and associated fees from Ocado Logistics to our UK clients. Recharges fromTechnology Solutions and from Ocado Logistics to Ocado Retail are eliminated on consolidation.

6. Net adjusting items* of £23.9m primarily relate to £186.5m income from the agreement reached with AutoStore to settle IP patent legal cases underwhich AutoStore will pay the Group £200.0m in instalments over two years, £(67.0)m change in IFRS 13 fair value relating to the revaluation of the M&Scontingent consideration and related costs, £(32.2)m UK network capacity review, £(27.4)m costs in relation to the Zoom by Ocado strategy andcapacity review, and organisational restructuring costs of £(15.5)m. Other adjusting items* include costs associated with Finance, IT and HR systemstransformation, acquisition costs of 6RS and litigation costs.

7. The Group has changed its segmental reporting for FY23 to reflect the Group’s three distinct business models: Technology Solutions, Ocado Logisticsand Ocado Retail. The FY22 prior year comparatives have been restated on the new segment basis. We have carried out a detailed exercise to ensureall costs are owned and managed within the appropriate segment. This has resulted in a different cost allocation to that used in the preparation of thepro forma numbers as presented in the FY22 results presentations for Logistics and Technology Solutions; Ocado Group adjusted EBITDA* loss of£74.1m at FY22 remains unchanged.

2023 Annual Report

Our 2023 Full Year financial results were announced on 29th February. Discover why we're the only player capable of helping our grocery partners to get a leading position through a profitable, scalable, e-commerce proposition.

Email alerts

Related Content

Reports and Presentations

Get the latest reports, presentations and news about all things Ocado Group here.

2023 Annual Report

Discover why we're the only player capable of helping our grocery partners to get a leading position through a profitable, scalable, e-commerce proposition.

Regulatory news

Read our latest regulatory news and sign up for email alerts to stay in the know.